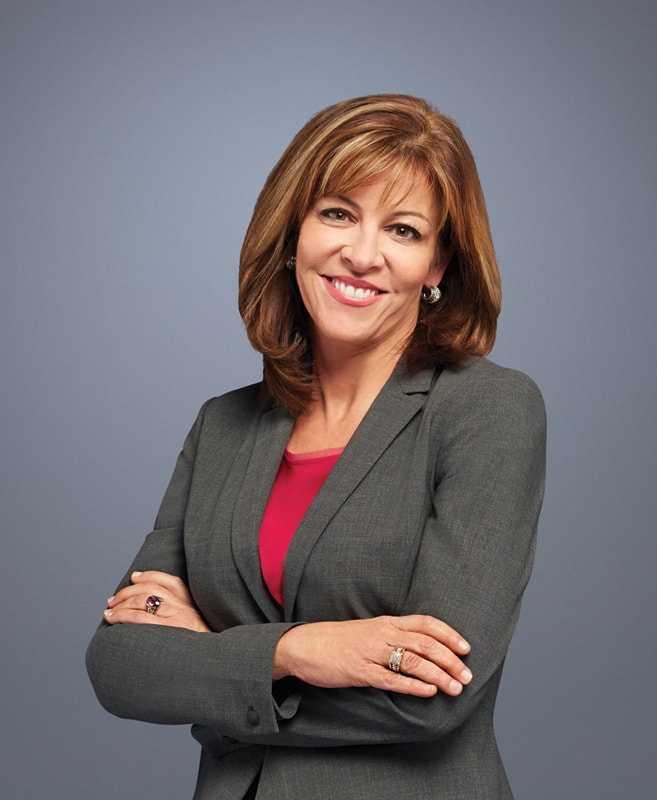

By Lisa Philp, RDH, President of Transitions Group North America

Lisa Philp, RDH, President of Transitions North America

Maintain your accounts without losing patients.

Making collection telephone calls is critical for past due amounts that are owed to the practice by the patient. The goal of your collection calls should be to maintain a good relationship with the patient while letting them know that you expect payment from them. You want to keep lines of communication open, and you want to get to a point where negotiation of an acceptable settlement is reached.

Ultimately, both the team member and the patient should feel good about the call and the resulting negotiation. The end result of an effective collection system is accounts receivable control.

Attitude is shown via your words and tone of voice when using the phone.

• Maintain a positive attitude. It is OK to expect patients/debtors to abide by their agreements. You respect them. You can expect respect in return.

• Stay calm. Losing your temper, becoming angry or getting defensive will only cause the debtor to do the same thing.

• Stay in control of the conversation by asking questions and by keeping the person involved in the conversation.

• When you ask a question, stop and let the person make a response. Do not feel like you have to fill in voids in the conversation. Pausing at appropriate times keeps you in control.

• Speak slowly, calmly, and clearly.

• Make sure that a firm agreement has been reached before the conversation ends.

AVOID the following:

1. Calls, anonymous or otherwise, made in a frightening, abusive or harassing manner.

2. Calls that interfere with the use of the telephone by other customers.

3. Calls for purposes that are against the law.

4. Calling at unreasonable hours in the day or night. (Do not call before 8:00 a.m. or after 9:00 p.m.)

5. Making one call after another to the same person.

6. Calls to people other than the debtor to discuss the past due account.

7. Calls that make threats.

8. Calls making false accusations about damaging a person’s credit rating.

9. Calls stating that legal action is going to take place if, in fact, it is not.

10. Calls demanding payments for a debt that is not actually owed.

11. Calls that give inaccurate information about the original agreement.

Lisa Philp, RDH is the president of Transitions Group North America, a full-service dental coaching company. To contact Lisa or to book her to speak at your event, you may reach her at info@transitionsonline.com 800-345-5157 or transitionsonline.com.